The 10-Minute Rule for Top 30 Forex Brokers

The 10-Minute Rule for Top 30 Forex Brokers

Blog Article

An Unbiased View of Top 30 Forex Brokers

Table of ContentsNot known Facts About Top 30 Forex BrokersTop 30 Forex Brokers Can Be Fun For EveryoneThe Facts About Top 30 Forex Brokers UncoveredTop Guidelines Of Top 30 Forex BrokersExamine This Report about Top 30 Forex BrokersGetting The Top 30 Forex Brokers To WorkAll About Top 30 Forex BrokersIndicators on Top 30 Forex Brokers You Should Know

Like various other instances in which they are made use of, bar charts provide more rate info than line charts. Each bar chart represents someday of trading and has the opening rate, highest cost, lowest cost, and closing cost (OHLC) for a profession. A dashboard on the left represents the day's opening cost, and a comparable one on the right stands for the closing rate.Bar graphes for currency trading assistance investors identify whether it is a customer's or vendor's market. Japanese rice investors initially made use of candlestick charts in the 18th century. They are aesthetically more attractive and much easier to review than the graph kinds explained above. The top portion of a candle is used for the opening price and highest cost point of a money, while the lower portion shows the closing price and lowest rate point.

The 8-Minute Rule for Top 30 Forex Brokers

The developments and shapes in candlestick graphes are utilized to determine market direction and movement.

Financial institutions, brokers, and suppliers in the foreign exchange markets permit a high quantity of utilize, meaning investors can control big settings with reasonably little cash. Leverage in the variety of 50:1 is typical in foreign exchange, though even higher amounts of leverage are available from certain brokers. However, leverage needs to be made use of very carefully since several inexperienced investors have endured significant losses using even more utilize than was essential or sensible.

The Top 30 Forex Brokers PDFs

A money trader requires to have a big-picture understanding of the economic situations of the various countries and their interconnectedness to understand the basics that drive currency values. The decentralized nature of foreign exchange markets implies it is less regulated than various other economic markets. The level and nature of regulation in foreign exchange markets depend on the trading jurisdiction.

The volatility of a certain currency is a function of several factors, such as the politics and economics of its country. Occasions like economic instability in the form of a repayment default or inequality in trading connections with one more currency can result in considerable volatility.

Unknown Facts About Top 30 Forex Brokers

Money with high liquidity have an all set market and show smooth and foreseeable price action in action to external occasions. The U.S. dollar is the most traded currency in the globe.

The Ultimate Guide To Top 30 Forex Brokers

In today's details superhighway the Forex market is no longer solely for the institutional capitalist. The last 10 years have actually seen an increase in non-institutional investors accessing the Forex market and the advantages it uses.

:max_bytes(150000):strip_icc()/Forex_Final_4196203-e44848b06f2642378b12bc162951a818.png)

Not known Details About Top 30 Forex Brokers

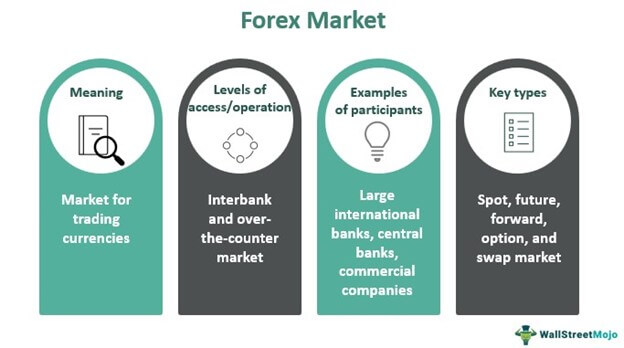

Forex trading (foreign exchange trading) is an international market for dealing currencies. At $6. 6 trillion, it is 25 times larger than all the globe's stock markets. Foreign exchange trading dictates the click here to find out more currency exchange rate for all flexible-rate currencies. Consequently, prices change continuously for the currencies that Americans are more than likely to use.

All currency professions are done in sets. When you market your money, you obtain the payment in a various currency. Every vacationer that has actually gotten foreign currency has done foreign exchange trading. As an example, when you take place holiday to Europe, you trade bucks for euros at the going price. You market U.S.

The Ultimate Guide To Top 30 Forex Brokers

Place purchases resemble exchanging currency for a journey abroad. Spots are agreements between the trader and the market maker, or dealership. The trader acquires a specific currency at the buy rate from the market manufacturer and offers a various currency at the asking price. The buy price is rather greater than the asking price.

This is the purchase cost to the trader, which in turn is the revenue gained by the market manufacturer. You paid this spread without realizing it when you traded your bucks for international money. You would observe it if you made the deal, canceled your trip, and then tried to trade the money back to bucks immediately.

Not known Facts About Top 30 Forex Brokers

You do this when you assume the currency's value will drop in the future. If the money increases in worth, you have to get it from the dealership at that cost.

Report this page